Experience the exceptional

At Traust Structured, our mission is to redefine structured finance by enabling high-growth businesses to access non-dilutive capital by collateralising intangible assets, including intellectual property, data, and proprietary innovations. We achieve this through comprehensive valuation, end-to-end risk management, and fully insured transactions that mitigate risks and maximize value. Rooted in trust, faith, and confidence, we partner with borrowers and investors to bridge the gap between traditional financing and the intangible-driven economy, fostering sustainable growth and market leadership.

Partnership for Growth

For businesses, intangible assets are valuable financial and legal commodities. Intangible assets are estimated to account for more than 80% of a company’s value.

Companies with strong intellectual property and data portfolios are ideal opportunities for investors.

⚊ Expansion and Flexibility

Borrow from Traust

Collateralization of your intellectual property and data can increase the amount of available credit to you. At Traust Structured we increase the potential for a successful loan by working closely with you in evaluating your intangible assets.

Requirements

$1M – $500M Annual Revenues

$5M – $1B Capital Needs

Owned or Controlled Intangible Assets (Intellectual Property, Patents, Trademarks, Quantifiable Know-How and Data)

Global Experience

Our team has significant experience in data, real estate

energy, healthcare, technology, media, agriculture

engineering, research and development, and finance around the globe

⚊ Resources

Facts and Figures

- Loan size from $30M to $150M (Average Loan: $60M)

- The typical term is 36-month

- Up to $150M in COLLATERAL PROTECTION insurance

- Compensation to TD2 may include warrant coverage

- Security interest in intangible assets granted

- Insurance for term of loan

- Flexible repayment schedule

- Balloon Payment in the final month of term

⚊ Resources

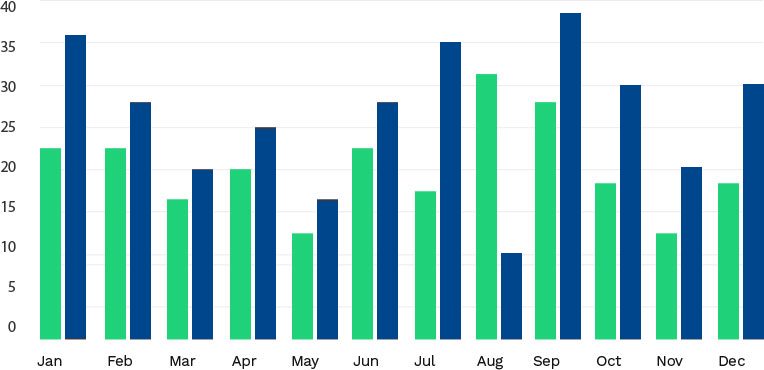

Projections

- Loan size from $30M to $150M (Average Loan: $60M)

- The typical term is 36-month

- Up to $150M in COLLATERAL PROTECTION insurance

- Compensation to TD2 may include warrant coverage

- Security interest in intangible assets granted

- Insurance for term of loan

- Flexible repayments schedule

- Balloon Payment final month of term