Facts and Figures

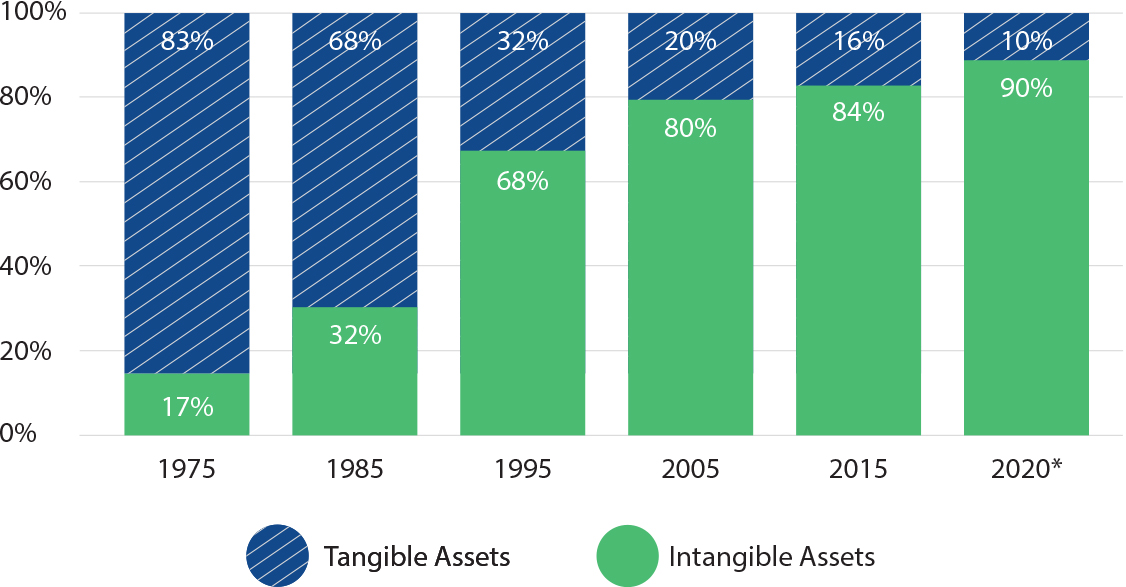

MASSIVE “NEW SOURCE OF COLLATERAL” FOR ASSET-BASED LENDING

Source: Annual Study of Intangible Asset Market Value from Ocean Tomo, Ocean Tomo LLC, 1 July 2020.

EXPANDED COLLATERALIZED DEBT FINANCING OPTIONS

First To Market Product

Partnership With #2 Insurance Provider In The World, Aon, plc

Significantly Expands Asset Based Lending

Companies Have a Debt Solution vs Equity Dilution

Traust Projects $500M of Loans in First Year

Companies Have a Debt Solution vs Equity Dilution

Traust has robust deal flow; $120 million in completed transactions plus $2 billion pending

TRIPLICATE UNDERWRITNG

Client (Borrower)

IP Portfolio W/ Commercialization Strategy

Traust D2

IP & Business Credit

Due Diligence

Traust Structured

Transaction Structuring & Underwriting

IP Solutions Team

IP Valuation W/ Pre-determined

Exit Plan and Underwriting

A-Rated Insurance Carrier Panel

Insurance

Policy Underwriting

Licensed Lloyds of London Syndicate Member

Insurance Policy

Traust Group with Capital Source, Carriers, AUM, and Client (Borrower)

Close IP Collateralized Loan

Traust has robust deal flow; $120 million in completed transactions plus $2 billion pending

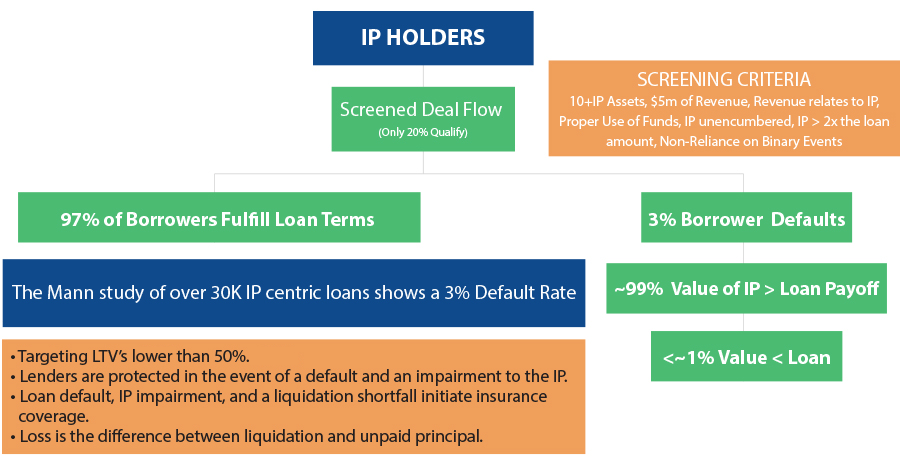

IP: RISK MITIGATED CAPITAL INVESTMENT

RISK Mitigated: Three Distinct Underwritings

- Traust Due Diligence & Underwriting

- Insurance Expert IP Valuation & Underwriting

- Insurance Carrier Panel DD & Underwriting

RISK Mitigated: Required Budget Review

- Quarterly Audits of Budget

- Budget Deviations Require Written Approval

- Budget Deviation Can Result in Default

RISK Mitigated: Three Debt Recapture Sources

- Borrower Monthly Payments

- IP and General Intangible Asset Liquidation

- IP Collateral Protection Insurance

IP: RISK MITIGATION

(LOW LTV/HIGH RECOVERY)