Projections

Traust has the First to Market advantage.

Traust has established relationships with Insurance Brokers & Carriers, Industry Experts and Capital Sources.

Traust Principals Have average of 25 years each experience with Credit Enhanced Project Financing. Traust spent three years developing and perfecting the proprietary structure, processes and products.

We anticipate a 3 - 5 year first mover advantage window for the banking industry in the US to realize the value of this untapped IP finance resource.

Traust Team Expertise: Business, Insurance, Intellectual Property, Loan Underwriting, Investment Compliance.

Capital Source Projections

- Traust Anticipated Loan Growth in year 1 to $500M

- Traust Anticipated Loan Growth in 3 years in aggregate of $1B – $3B

- Traust Anticipated INTEREST paid to Capital Source investing $500M in year 1is as follows:

- Insured: approx. $10M – $30M (ROI: 2% – 6%)

- Uninsured: approx. $25M – $35M (ROI: 5% – 7%)

- Traust Anticipated INTEREST paid to Capital Partner in 3 years in aggregate investing $500M is as follows:

- Insured: approx. $30M – $90M (ROI: 2% to 6%)

- Uninsured: approx. $75m – $105m (ROI: 5% to 7%)

STATUS & TIMELINE

Initial ~ $120M in transactions ready To Close

~ $590m In transactions currently in financing process

Traust has a pipeline of more than 15 transactions

Building infrastructure to support future growth

EXPANDED COLLATERALIZED DEBT FINANCING OPTIONS

First To Market Product

Partnership With The Largest Insurance Providers In The World,

Significantly Expands Asset Based Lending

Companies Have a Debt Solution vs Equity Dilution

Traust Projects $500M of Loans in First Year

Companies Have a Debt Solution vs Equity Dilution

Traust has robust deal flow; $120 million in completed transactions plus $2 billion pending

TRIPLICATE UNDERWRITNG

Client (Borrower)

IP Portfolio W/ Commercialization Strategy

Traust D2

IP & Business Credit

Due Diligence

Traust Structured

Transaction Structuring & Underwriting

IP Solutions Team

IP Valuation W/ Pre-determined

Exit Plan and Underwriting

A-Rated Insurance Carrier Panel

Insurance

Policy Underwriting

LICENSED LLOYDS OF LONDON SYNDICATE MEMBER

Insurance Policy

Traust Group with Capital Source, Carriers, AUM, and Client (Borrower)

Close IP Collateralized Loan

Traust has robust deal flow; $120 million in completed transactions plus $2 billion pending

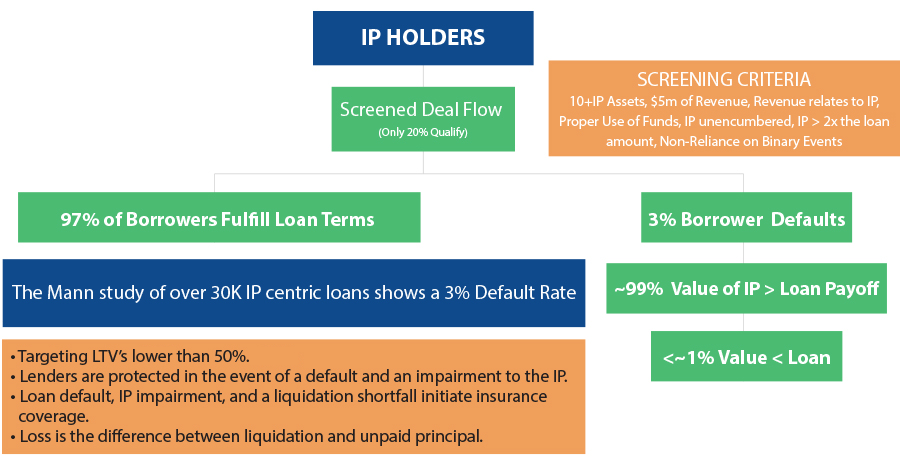

IP: RISK MITIGATION

(LOW LTV/HIGH RECOVERY)